tax deductions for high income earners 2019

Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund. Long-term capital gains tax rates are zero 15 percent and 20 percent for 2018 depending on your income.

Here S A Breakdown Of The New Income Tax Changes

A 10000 cap on deductions for state and local property sales and income taxes.

. The limits are more than 200000 for individuals 250000 for couples filing jointly or 125000 for spouses filing separately Higher payroll taxes will affect individuals. Premium Federal Tax Software. New limits on deductions for some mortgage interest and home equity debt.

Increase Charitable Donations 51 Make the Most of It 6 6. The age for required minimum distributions rmds from retirement accounts was. Consider a 500 donation from a high earner in the 37 tax bracket and a similar donation amount from a taxpayer in the 10 bracket.

The benefit of credits and exemptions is also reduced as income rises. That means that if you earn more than 170050 in gross income as a single earner and 340100 if you are married and filing jointly you are a high-income earner. Division 293 tax is an additional tax on super.

Tax deductions for high income earners 2019 Tuesday June 14 2022 Edit. Ad Easy Software To Help You Find All the Tax Deductions You Deserve. The same donation amount will help the high.

It would look like the following. Using the three percent calculation 150000 x 03 they would have to reduce their deductions by 4500. The Setting Every Community Up for Retirement Enhancement SECURE Act which was part of the December 2019 tax package includes several provisions.

Maximize Tax Credits 41 Make the Most of It 5 5. Assuming they normally deduct 10000 for mortgage interest. Tax Reduction Strategies for High-Income Earners 2022 8883207400.

The SECURE Act. These include mortgage interest and property tax deductions and deductions for charitable contributions. The deduction is meaningful with 5000 for single filers and 10000 for married couples filing jointly.

Tax Deductions For High Income Earners 2019. How To Reduce Taxable Income For High Income Earners In 2021. Most states offer a tax deduction for contributions made to their 529 plan.

In Georgia however the deduction is only 2000 for individuals and. Long-term capital gains tax. There are a few different tax deductions for high earners including the mortgage interest deduction the state and local taxes deduction and the charitable donations.

5 Outstanding Tax Strategies For. Do a 1031 Exchange 61 Make the Most of It 7 7. For the 2022 tax year in Wisconsin the maximum deduction for most filing statuses is 3560 1780.

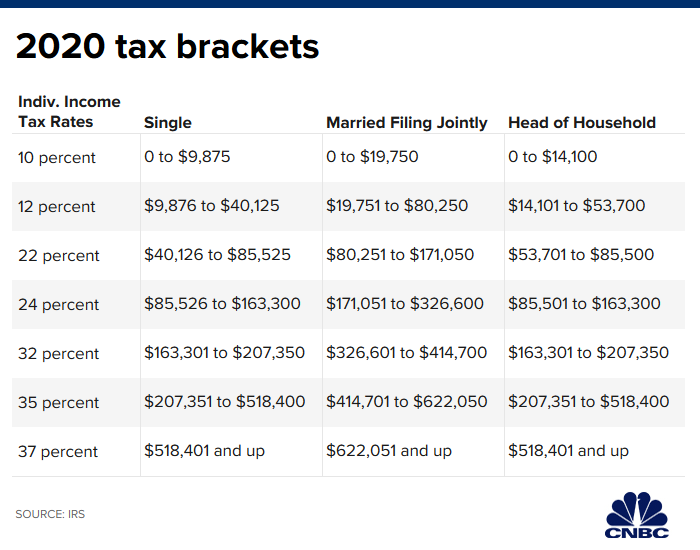

For taxable year 2019 the standard deduction increases to 4500 for single taxpayers or married taxpayers filing separately was 3000 and to 9000 for taxpayers who. Federal tax brackets on wages go from 10 percent for the lowest. Whereas that deduction used to be unlimited its now capped at 10000 a year.

The next two largest deductions claimed by high-income households in 2014 were the charitable deduction 108 billion and the home mortgage interest deduction 63 billion.

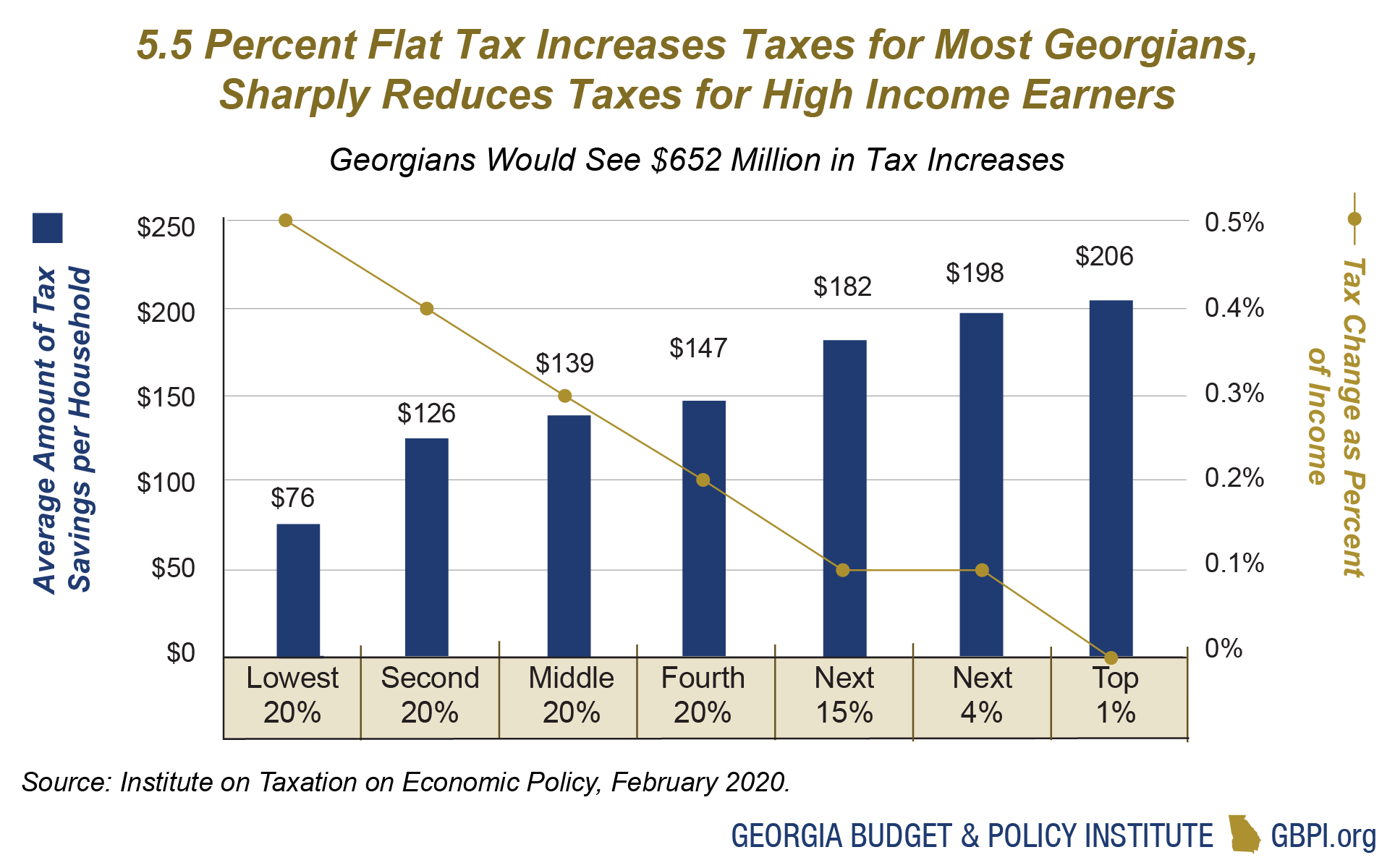

Georgia Leaders Face Choice Between Tax Cuts For High Income Earners And Funding Key State Priorities Georgia Budget And Policy Institute

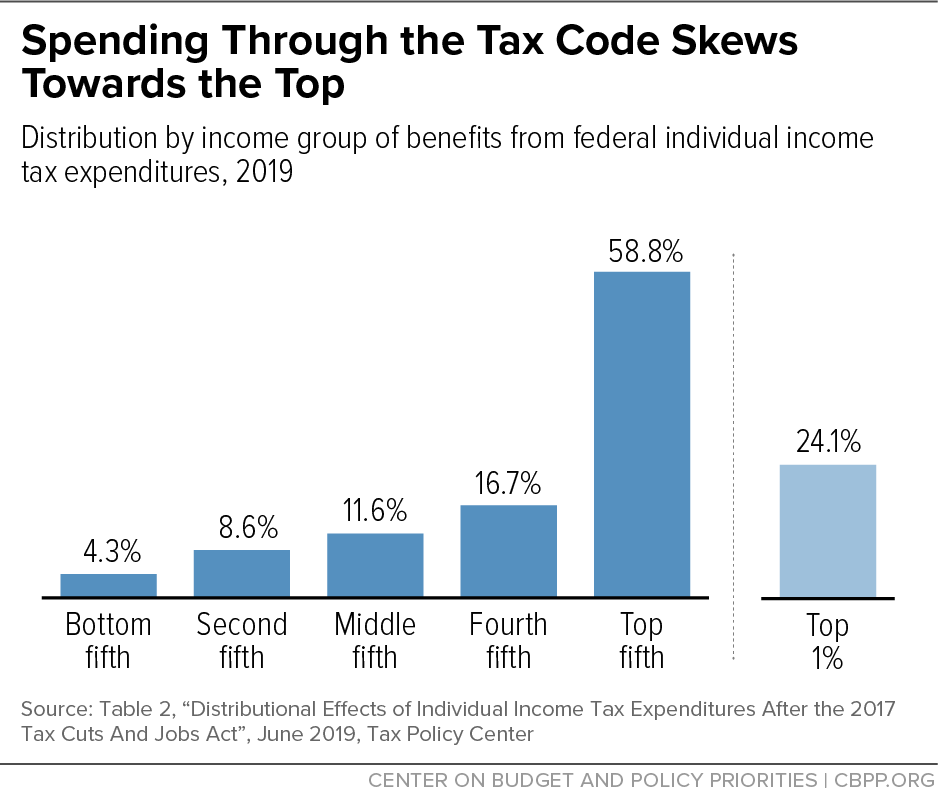

How Does The Federal Tax System Affect Low Income Households Tax Policy Center

U S Income Tax Policy Is Mostly About The 1 Justin Fox

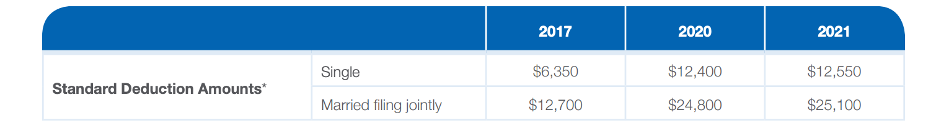

Personal Finance Ep 91 Does Marriage Really Save You On Taxes It Depends On Income Disparity Dollars Ense La

Policy Basics The Earned Income Tax Credit Center On Budget And Policy Priorities

Tax Strategies For High Income Earners Wiser Wealth Management

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

Policy Basics Federal Tax Expenditures Center On Budget And Policy Priorities

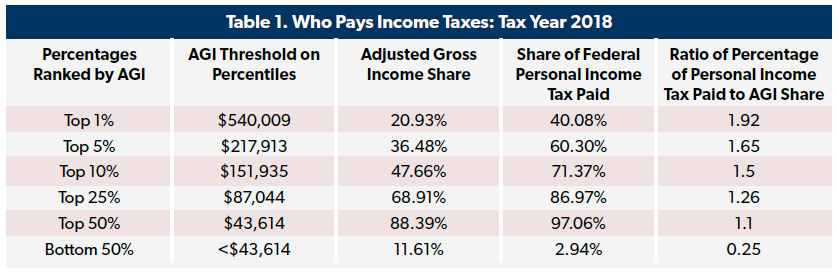

Who Pays Income Taxes Foundation National Taxpayers Union

Explainer The 4 Trillion U S Government Relies On Individual Taxpayers Reuters

5 Tax Deductions For High Earners Plus A Tax Hack The Physician Philosopher

The Marriage Tax Penalty Post Tcja

The Tax Cuts And Jobs Act In Georgia High Income Households Receive Greatest Benefits Georgia Budget And Policy Institute

How The Tcja Tax Law Affects Your Personal Finances

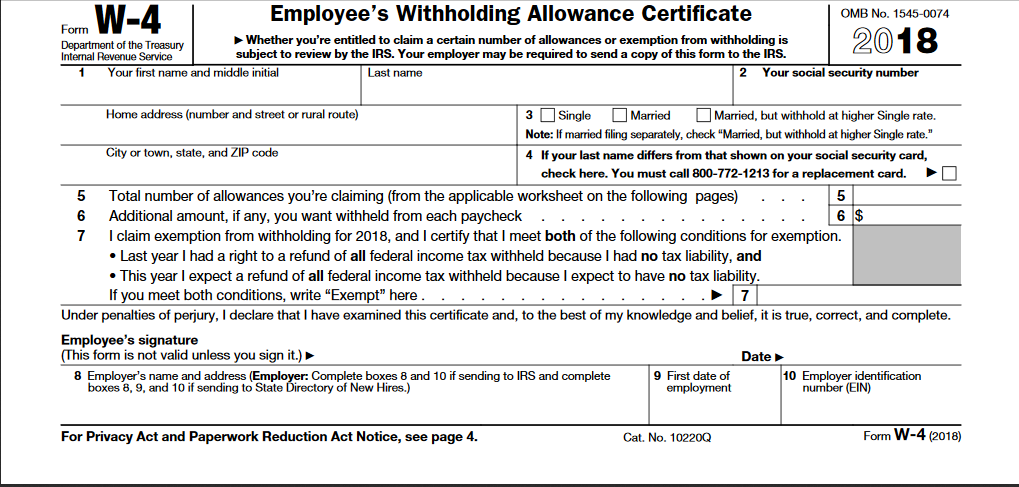

High Income Wage Earners Need To Review Their W 4

Tax Planning Tips For High Income Earners

5 Outstanding Tax Strategies For High Income Earners

The 4 Tax Strategies For High Income Earners You Should Bookmark

Minimizing Taxes And Protecting Assets For High Income Earners